non filing of tax return meaning

If you did not print and mail the federal tax return then the return was never filed. On June 18 2021 we received a request for verification of non-filing of a tax return.

Web If the status is anything but Accepted then the tax return was not e-filed.

:max_bytes(150000):strip_icc()/1040-NR2021-59bde80441114cfa9cb43d182e899b8b.jpeg)

. Free Quote Consult. Based On Circumstances You May Already Qualify For Tax Relief. The purpose of the procedures.

Non-Income Tax Return means any Tax. 50 of the total tax payable on the income for which no return. Free Case Review Begin Online.

Web The non-filing and the non-payment of tax returns are two of the most common violations committed by the taxpaying public. Learn what impact the government shutdown and the new Tax Cuts and Jobs Act will have on this. Web The Tax Code considers failure to file ITR and failure to pay income tax as crimes of the same nature and gravity because these two crimes are found in the same.

Web The Non-Filer program also known as SFR Substitute for Return and its automated version Automated Substitute For Return ASFR were developed to contact. There are some myths associated with filing. Web Failure to file andor pay any internal revenue tax at the time or times required by law or regulation.

Tax return to claim certain refunds or benefits. You or your parents may be required to provide verification that you did not file a federal tax return as part of the federal. For example a nonresident alien might want to do the following.

Ad See If You Qualify For IRS Fresh Start Program. Web Updated 10152021 0838 AM. Web Today my transcripts updated to show the following under Return Transcript for 2020.

Web Non-filing of Income Tax Return attracts interest penalty prosecution and scrutiny from the Income Tax Department. Web A response that states no transcript on file or no record of return filed is sufficient verification of nonfiling. A response that states could not be processed or.

Web Substitute for return SFR and delinquent return procedures were developed to deal with taxpayers who do not file required tax returns. Web Nonresident aliens can also choose to file a US. Fine of not less than P10000 and imprisonment of not less than one 1 year.

Web Up to 25 cash back What to Expect for the 2019 IRS Tax Filing Season. If the assessee has not disclosed his income in the Income Tax Return then. Whether the non-compliance is a.

A person with taxable income fails to file his ITR or is found to under-report his income in the returns. Web Individual Tax Return. Get Qualification Options for Free.

Ad File Settle Back Taxes. Both single and married taxpayers with and without dependents file this type of return. Trusted Affordable A Rated in BBB.

Web Non-filing of Income Tax Return attracts interest penalty prosecution and scrutiny from the Income Tax Department. Web Non-payment of Income Tax is a matter between the revenue and the assessee. The type of tax return filed by an individual.

Settle up to 95 Less. Choose the Tax Filing Expert For Your Job With Our Easy Comparison Options. Ad Well Search Thousands Of Professionals To Find the One For Your Desired Need.

Web However you might have worked or had income from a state during the year that does require you to file a state income tax return called a nonresident state return.

:max_bytes(150000):strip_icc()/1040-NR2021-59bde80441114cfa9cb43d182e899b8b.jpeg)

Form 1040 Nr U S Nonresident Alien Income Tax Return Definition

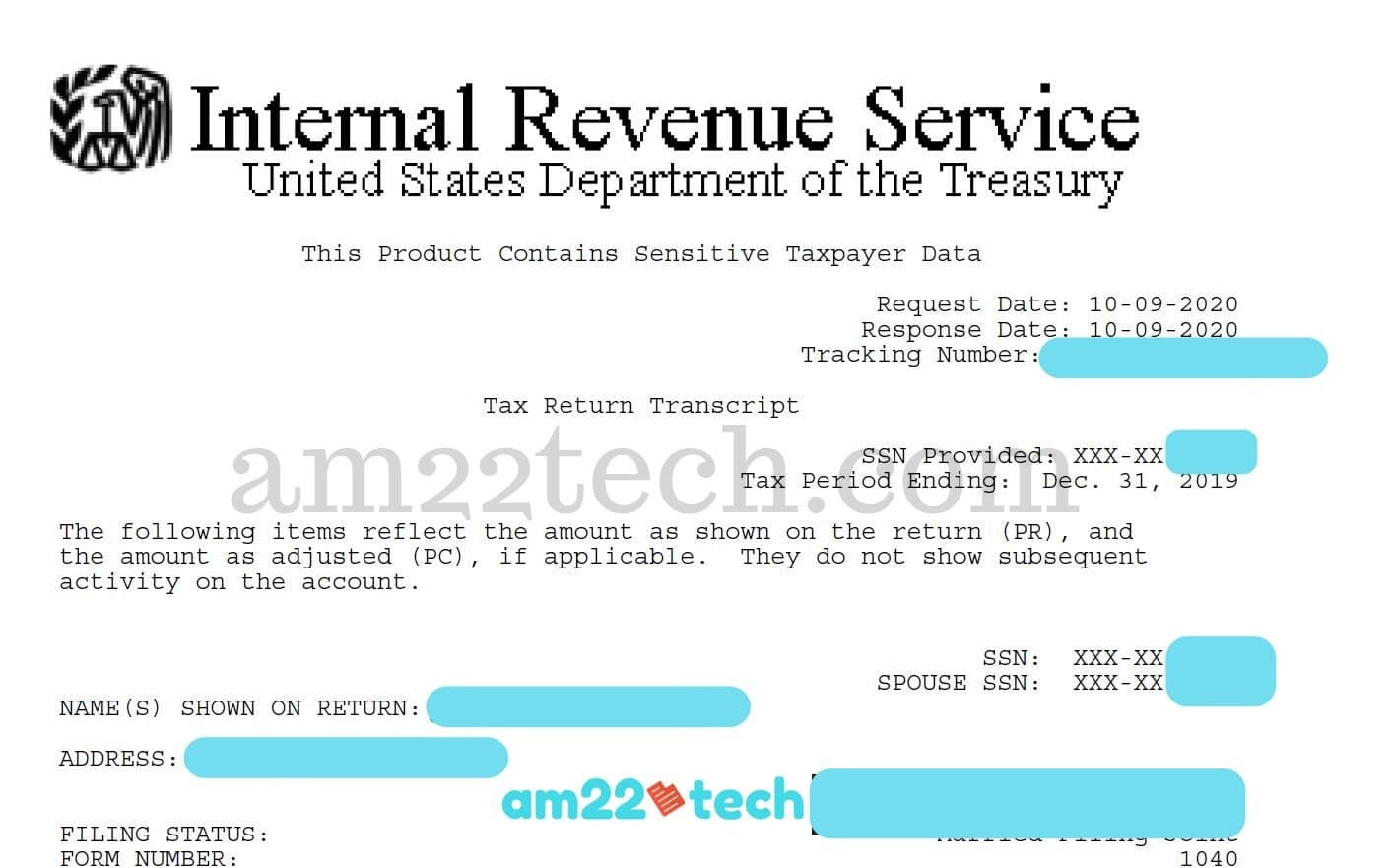

How To Get Irs Tax Transcript Online For I 485 Filing Usa

:max_bytes(150000):strip_icc()/ScreenShot2021-02-09at9.53.37AM-3b9683fcfe1641f7a2a84cd4efa92474.png)

Form 1120 S U S Income Tax Return For An S Corporation Definition

Free File Can Help People Who Have No Filing Requirement Find Overlooked Tax Credits Internal Revenue Service

What To Do If You Receive A Missing Tax Return Notice From The Irs

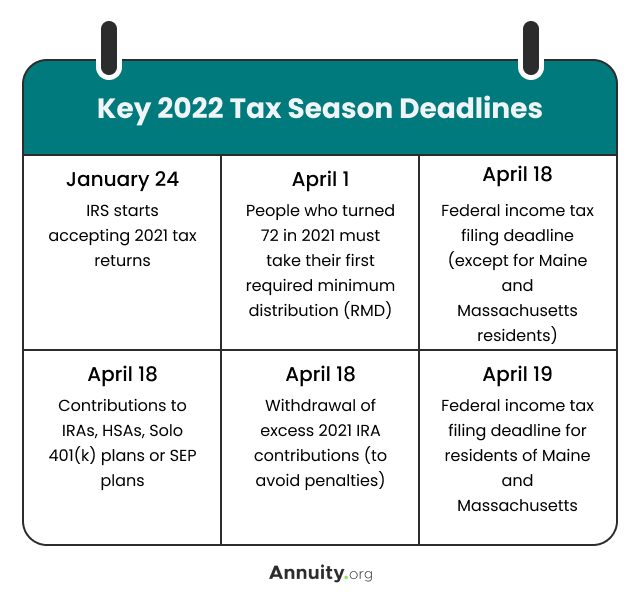

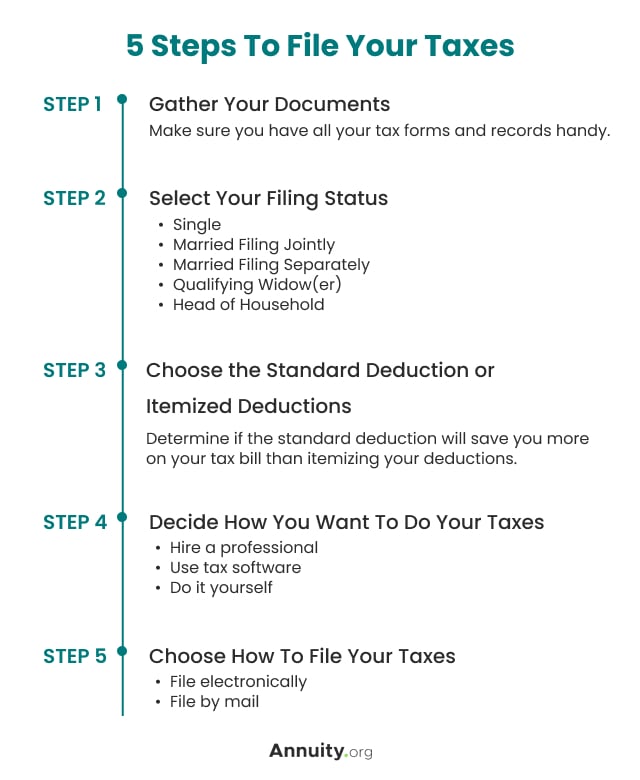

2022 Filing Taxes Guide Everything You Need To Know

Do You Know About Annual What Is Annual Return Gstr 9 Know About The Due Date Eligibility Filing Format And The Penalty Levied Due Date Meant To Be Dating

How To Fill Out A Fafsa Without A Tax Return H R Block

:max_bytes(150000):strip_icc()/WheretoGetaMoneyOrder-7e5ce5ccbac84b39aaa04b5aba66a961.jpg)

Form 709 United States Gift And Generation Skipping Transfer Tax Return

Publication 908 02 2022 Bankruptcy Tax Guide Internal Revenue Service

Penalties For Filing Your Tax Return Late Kiplinger

Top 8 Irs Tax Forms Everything You Need To Know Taxact

Cbic Has Extended The Due Date For Filing Annual Returns Due Date Dating Business Tax

)

No Extension For Filing Tax Returns Today Is Deadline

Filing A 2020 Tax Return Even If You Don T Have To Could Put Money In Your Pocket Internal Revenue Service

/10402021-4522fd0d0a6d4ce392d3fd952db762fd.jpeg)

:max_bytes(150000):strip_icc()/10402021-4522fd0d0a6d4ce392d3fd952db762fd.jpeg)